Content

The report displays amounts by the quarterly fiscal period type. With this financial structure https://www.bookstime.com/ option, budgets and forecasts are maintained on projects and rolled up to the program.

The most financially disciplined businesses leverage all three tools in their planning and operations. Although budgeting and financial forecasting are often used together, distinct differences exist between the two concepts. Budgeting quantifies the expected revenues that a business wants to achieve for a future period. In contrast, financial forecasting estimates the amount of revenue or income achieved in a future period. There must be fiscal time periods, with a period type of monthly or 13 periods, created (Administration/Finance-Setup/Entities-Fiscal Time Periods Tab).

Budgeting vs Financial Forecasting Comparison

Overall, forecasting is a more useful tool to use for your business, as it provides you with a more insightful understanding of the actual circumstances that your business is facing. Whereas forecasts can be used to spur immediate action, budgets often provide unachievable targets or goals that simply bear no relation to current market conditions.

- Finally, forecasts are updated monthly, as time progresses and more is known.

- Planningprovides a framework for a business’ financial objectives — typically for the next three to five years.

- The budgets are prepared for the forthcoming period, considering various objectives of the business organization such as vision, mission, goals, objectives, and strategies.

- You can’t predict the future, so don’t spend a lot of time to get it just right.

- Clone the POR to create an Active plan that you will use to update for changes in assumptions or projected amounts.

- Because the future of an organization is undefined, financial planning is a perpetual process.

But there exist a fine line of differences between budget and forecast, which we’ve discussed in the given article. Budget implies a formal quantitative statement of income and expenditure for a certain period. It is a plan for the resources allocated for the completion of the activities, that requires budget vs forecast to be followed, to achieve the desired end. It is not exactly same as forecast, which is a simple estimation of the future course of event or trend. It is a forward looking activition, which encompasses projection. A forecast also helps you react to change in a way that a budget does not.

What Is the Budgeting and Forecasting Process?

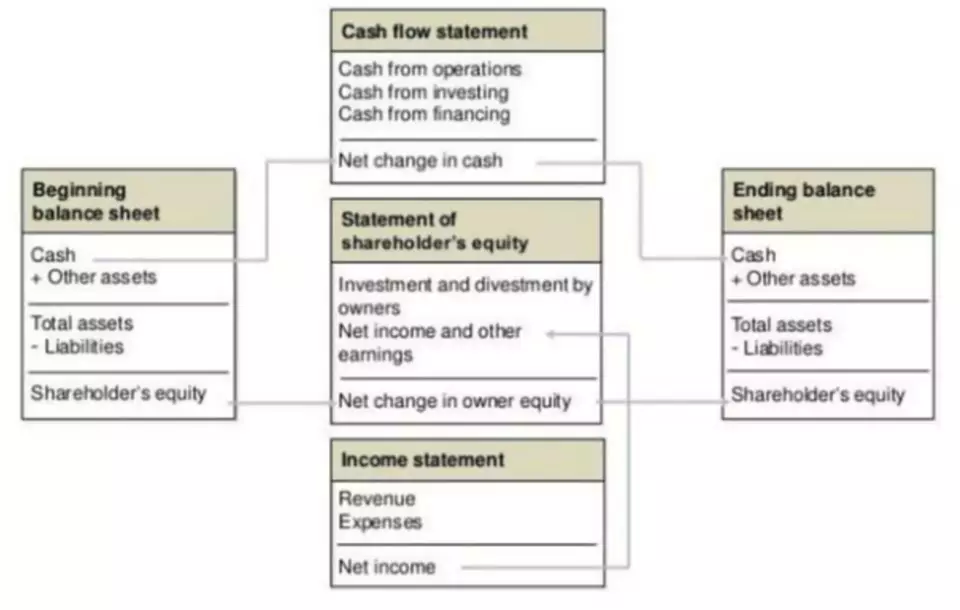

A financial plan expressed regarding money, prepared by the management in advance for the forthcoming period, is called a budget. The forecast is an estimation of future business trends and outcomes based on historical data. A budget reveals the shape or direction of a company’s finance, while the forecast tracks whether or not the company is meeting its financial goals as outlined in the budget. Long-term financial forecasting may be done without first having a budget, but it would likely use past key indicators from previous budgets. Realistically, the more useful of these tools is the forecast, for it gives a short-term representation of the actual circumstances in which a business finds itself. The information in a forecast can be used to take immediate action.

- They also use forecasts to identify trends that are used to grade the company’s financial position.

- For the total revenue, you can see that the forecast is trending in the same direction as the budget, but the numbers aren’t quite as high.

- Software applications such as Microsoft Excel became widely popular for financial reporting.

- The Budget Preview grid will be updated with the last saved distribution values.

- If you didn’t, you have an opportunity to not make the same mistake again.

When you prepare a budget you’re steering the ship in the direction you want to travel. Your budget also creates the baseline that will allow for comparison and analysis as you progress. Budgets are an actionable step, and are always accompanied by specific spending and tracking habits.

What’s the difference between budgeting and financial forecasting?

Below, we explain those similarities and also how budgets allocate funds, while forecasting makes those allocations. It considers the question of whether everything in the budget delivers value for the business by examining whether each line item creates value for customers, staff or other stakeholders.

Tags: