What Are The Pros And Cons Of Payday Loans

The applicant must be a US citizen, earn at least $1,000 monthly, and have access to a checking account to receive direct deposits. CreditSmart® is a suite of educational resources designed to empower consumers with the skills and knowledge to assist them through every stage of their financial capability and homeownership journey. If the lender agrees, additional fees and interest will be added to the total. Check City acts as a credit services organization/credit access business CSO/CAB in Texas. In particular, the OCC, Federal Reserve, and FDIC should advise banks to keep interest rates on all loans to no more than 36% interest, and the NCUA should not expand loans permitted to exceed the federal 18% interest rate cap applicable to federal credit unions. It could be because of many reasons. Note that timing of the receipt of the funds depends on your bank. Click apply below, form takes about 3 minutes. Customers who use our credit score feature for 2+ years and improve their credit see an increase of 30 points, on average. Customer Service will contact you via a call or text. 815 ILCS 122/4 5 815 ILCS 122/4 5 Sec. The most important factor that we consider when we look at your loan application is your income and whether or not you have the financial means to repay your loan which is why it’s easier than ever to qualify for unsecured loans for poor credit. With synthetic turf, you don’t have to worry about this. You May Also Like: 12 Factors To Be Considered before Choosing A Loan Management System. However, should you choose any other loan finders listed in our review, you’re guaranteed professional service and cash in a veritable flash. March 2, 2021 11 min read. Amazing through and through. Perhaps the most prestigious designation in the portfolio management and investment industries, the CFA charter requires candidates to pass each of three successive exams covering a variety of financial, economic, mathematical and ethical topics. The calculation above is not an offer, but only a simulation of a possible situation. Payment Plan with CreditorsThe best alternative is to deal directly with your debt. Apply Now For An Instant, Online, No Obligation Loan Offer. Between July 2021 and September 2021, more than two thirds of personal loans issued by LendingClub Bank were funded within 48 hours after loan approval. Eligibility requirements: Upstart offers quite a bit of insight into its loan eligibility requirements. License PL 21 Maximum funded amount for payday loans or installment loans depends on qualification criteria and state law. Not all states allow payday lending, but those that do require payday lenders to be licensed. A payday loan is a small loan which can be taken out for up to 35 days – typically until your next payday, hence the term payday loans.

Congratulations, luv! You are eligible to apply for a Quick Loan Get into your Tonik App to apply now!

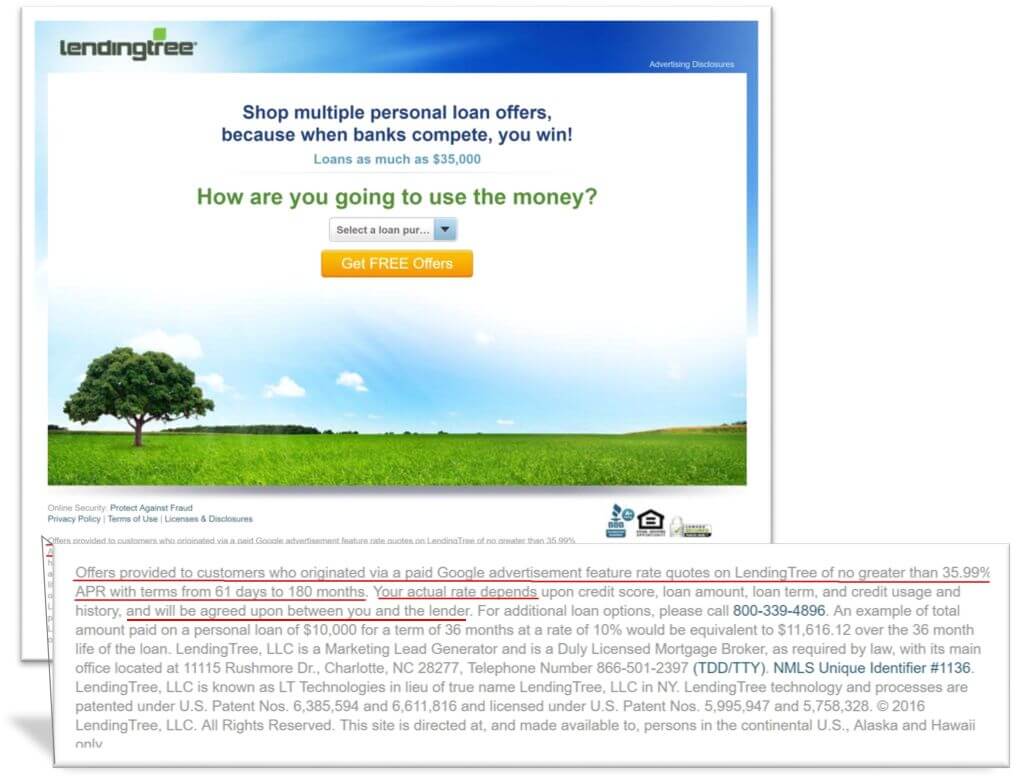

This is because lenders review your monthly income and outgoings amongst other things in order to decide whether you can afford to repay the loan you have applied for. So whatever you’re in the market for, it’s a good idea to shop around. Authorised and regulated by the Financial Conduct Authority. If you are interested in any of these products, you can get a loan on our website or browse it for more options. You’ll be offered fairly flexible repayment options that range up to 24 months depending on the loan amount, of course, with the option to pay your installments once a month, every two weeks, or weekly. Provincial laws prevent payday lender from asking you to sign a form that transfers your wages directly to them. OK92033 Property and Casualty Licenses. Sunny Loans is a registered trading name of Upward Finance Limited, who is an introducer appointed representative of Flux Funding Limited, who is a credit broker, not a lender. These days, the most common way to apply for a vehicle title loan is to do so online. Satyam Kumar is the co founder and CEO of LoanTap. To get a payday loan, borrowers are asked to write a personal check for the amount of the debt plus any finance fees. You can also schedule an appointment to be called when you will be available. Meantime, many of nearly half a million Missourians with federal student loans who applied for relief under the Biden plan are watching the case with anticipation. Or its licensors or contributors. In the instance of joint applicants, the Qantas Points by default will be awarded to the primary applicant annually unless you opt to either split the points between the secondary or primary applicant or award the points in full to the secondary applicant. When it comes to bad credit personal loans, guaranteed approval $5000 is a great option for those who need financial assistance. They can be the perfect short term financial solution when you need money now. Finance charges on these loans also are a significant factor to consider, as the average fee is $15 per $100 of loan. We understand that you may have made mistakes in the past and that certain circumstances can lead to a poor credit rating. Worum geht es in diesem Guide. If you are in a position where you need money, the last thing you want is money taken from your account. The repayment amount cannot be lower than 5% of the credit facility’s initial balance.

Legitimate Payday Loans Online Reputable Destination to Connect with the Top and Trusted Lenders

Law and finance firms are legally required to perform credit checks on potential employees. The loan provider agrees to extend a car title loan for $1,250. This could help you if you have an urgent financial commitment. Each of these companies offer competitive rates and a wide range of services. Payday loans can hit you with fees for not repaying them on time or in full. 25% discount for automated payment from a PNC checking account. No one can fully guarantee a loan. This allows you to stop the interest from building after 35 days. Ask yourself: ‘Will I be able to maintain my monthly payments and repay the loan in full and on time. Small dollar bank Men’s Lifestyle and Fashion loans: Some major national banks have introduced new small, short term loans in recent years. Repayment schedules to suit you. A payday loan could be a great option if you have a sound financial history but just need some extra cash to cover an expense. For example, if your house is worth $250,000 with an outstanding mortgage of $160,000, you have $90,000 in equity you can use as collateral for a home equity loan or line of credit. Therefore, the presence of such businesses is undeniably game changing for the online lending industry. Alternatives to auto title loans are preferred by the vast majority of borrowers. Many lenders will see a low credit score as a reason not to approve loans, and it can affect your ability to obtain credit from established lending sources or from being accepted for a mortgage or other secured loans. But a payday loan is likely to be the wrong choice for you if. Our panel of reputable and transparent direct lenders offers flexible loans, starting at $100, with convenient repayment options. To help you start comparing we’ve wrapped up some competitive refinance offers below. These are loans with equal payments over a fixed period. Here is a list of our partners and here’s how we make money. Title loans subject to minimum auto value requirements. Registered Office: Sunny Loans, 7 Bell Yard, London, England, WC2A 2JR. Qualifying for these jobs typically requires a high school diploma or General Educational Development certificate, commonly referred to as a GED. “Very often, it’s the day after the closing date on your statement, but not always,” she says. It is also possible to take a loan from a 401k account. Inviting Borrowers with Poor Credit. If you feel overwhelmed by debt, call a certified credit counselor or get started online for a free analysis of your financial situation.

How do I compare home loan rates?

Alternatives to a title loan should be considered before applying for one. Whether you’re applying for loans online the same day or opting for a same day loan in person, the application process is guaranteed personal loans quick and easy. The information contained herein is provided for free and is to be used for educational and informational purposes only. Loan Pig is both a direct lender and a credit broker. Just remember, it’s not about fixing it all in one go. Representative Example. The majority of car loans have monthly payments of principal and interest and are usually paid off in 5 7 years. Overdraft facility for Salaried Customers. To conclude with our selection process, we proceed to test the customer support service. Using a credit card could be an option if you need short term funds — but if you can’t pay off the expense in full by the time your payment is due, you’ll have to pay higher interest. Customisable EMI Plans. The main advantage in using a broker is sheer volume. MoneyMutual is a trusted financial services provider that specializes in helping those with bad credit access emergency loans. Usually, small business loan applications can take longer and come with their fair share of difficult requirements. We deposit your money right into your bank account. Fixed monthly payments: Fixed interest rates and predetermined monthly payments make it easier to plan your monthly budget. We acknowledge the stories, traditions and living cultures of Aboriginal and Torres Strait Islander peoples on this land and commit to building a brighter future together. Quickly Compare Loan Offers Up to $5,000 >>> Browse Pockbox For Free. At Payday Bad Credit, our entire application for emergency loans are online. You may obtain a copy of the disclosure by visiting a branch or calling 800 872 2657. Default also opens you up to harassment from debt collection agencies, who either buy the loan from the payday lender or are hired to collect it. Getting a no credit check loan is less of a hassle when you use a loan matching service like PaydayChampion to help you connect with a suitable borrower. The sign up process is simple and fast just a few minutes and you’ll get feedback on your application in no time. When you need funds fast, and you want to repay it slow – choose guaranteed installment loans for bad credit. Consult a financial expert for help. You’re eligible if you’re 21 or over and live in the UK permanently, you have a regular yearly income of £7,500+, you can make your repayments by Direct Debit, and you haven’t been declared bankrupt, had a CCJ or an IVA within the last 6 years. Bad credit loans may seem like the perfect solution when you are in need of a quick, easy loan with no credit checks.

BUSINESS LOANS

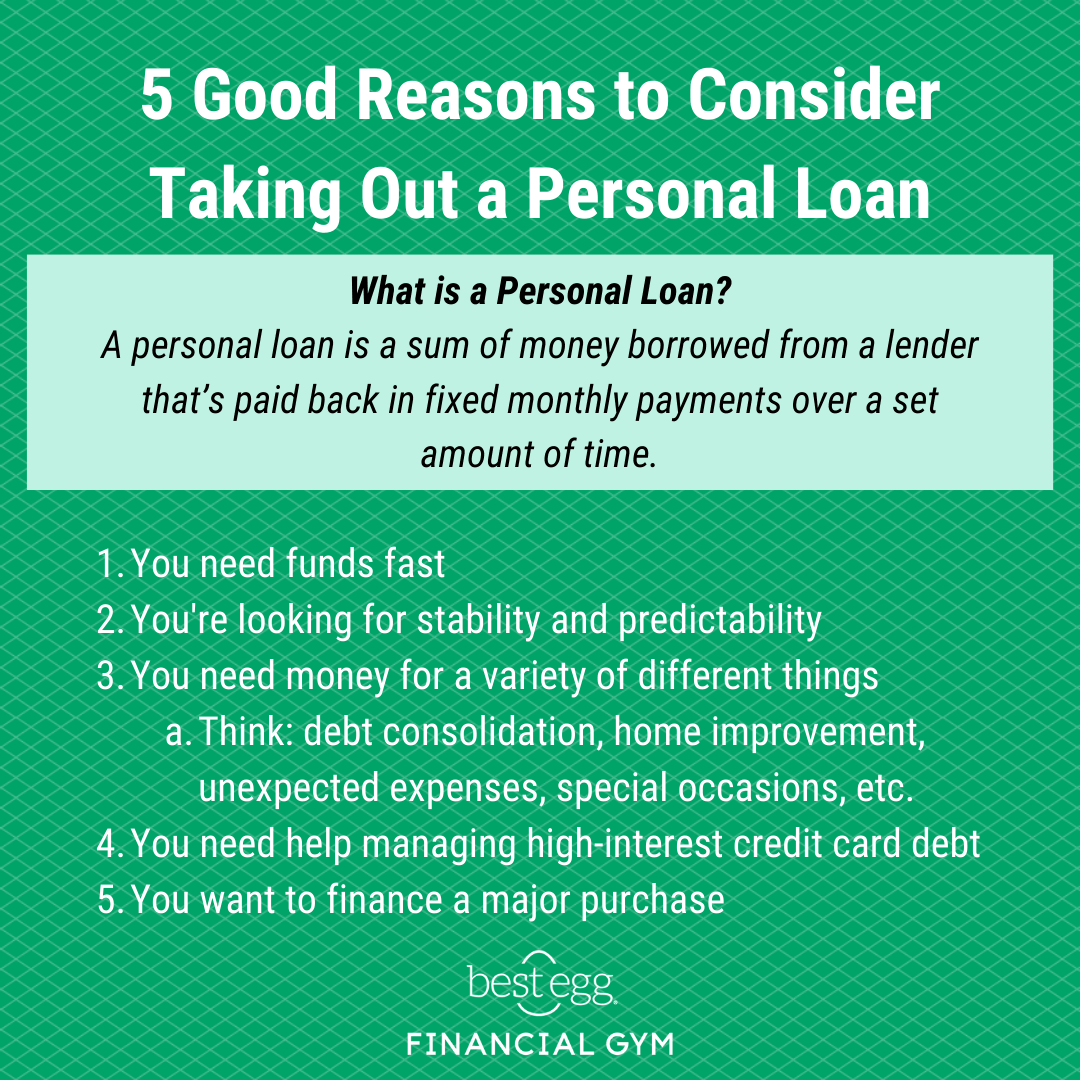

A: A personal loan for bad credit is a loan that is specifically designed for people with bad credit. It is a business overdraft account without any hassles of banks. With these loans, you only borrow money for a short amount of time, and the loan is usually quite small, so you can pay it back faster. How Much Can I Make with the Best Loan Affiliate Programs. You can also choose the repayment terms that work best for your budget, making it easier to manage your finances. If we are not able to do this, we may transfer you directly to alternative firms and services which may incur a monthly fee, such as credit building tools if you choose to use them. » MORE: How to build credit. Certain other terms and conditions may apply. Find a branch or make an appointment with a banker to learn more. Certain other eligibility requirements and terms and conditions apply. Loans for people with no credit can be expensive, especially on the short term loans market, and borrowing irresponsibly can cause you serious money problems. Report on time payments to credit bureaus to help build your credit. This credit check is called a hard inquiry, or “hard pull,” and temporarily lowers your credit score a few points. Booking travel early often rewards customers with a whole range of perks. Results shown are for. Also, payday loans won’t show up on your credit report after you’ve accepted the loan. This is to be paid back over a period of 3 to 6 months, which allows you to choose a repayment plan that suits your current finances. Using a personal loan to pay off debt helps you get rid of multiple payments and go down to one payment per month — and hopefully with a much lower APR. To complete your application for a personal loan through PaydayDaze’s lender network, fill in the online form with your data. Highlights of Online Loans for Bad Credit Borrowers with No Storefront Visit and 100% Digital Application. Lenders want to know if you’ve previously made timely payments on past credit accounts or loans, and your payment history is typically the number one indicator of this. While it may seem like the answer, filing should be a last resort.

The ‘King Kong’ of Weight Loss Drugs Is Coming

Your money will be sent to you via e transfer in 2 minutes or less. Contact the NH Bank Commissioner if the problem is with a New Hampshire bank. A secured loan is a personal loan that is secured against an asset so that if you were unable to repay the loan, the lender could claim against that asset. They receive a commission for every lead they deliver to the Dr. However, if you decide to borrow cash from family or friends and do not pay the money back, it could put a strain on your relationships and you may find yourself in an uncomfortable position. We try and offer a way forward for each of our customers, regardless of what’s happened in the past. Applicants could even get loans up to $10,000 for themselves. Edit or remove this text inline or in the module Content settings. If you want to add a new type of credit account to your credit mix, be sure to balance the risk versus reward. After your loan request is approved, the lender will contact you directly and provide a loan agreement. We pick some to share that others could be asking themselves and hope to help many in sharing these answers.

Borrowers Corner

If you’ve always been a good borrower with an impeccable repayment history, you may already be eligible for an instant pre approved loan from Fi Money. Under the law, there’s a cap on most payday loan fees. This is when debt can begin to pile up for many borrowers. No collateral is needed when you apply for unsecured loan 100 approval options – you can get up to $5000. If your loan is for a primary residence, you’ll typically have a three day rescission period after closing. At TitleMax, we also work to get you as much cash as we can at very competitive rates. 4% and can be repaid over a period up to 48 months. The Loan Agreement will contain the complete list of APR, fees and payment terms. A total of 17,750 firms responded to the 2021 SBCS; 10,916 were employer firms, and 6,834 were nonemployer firms. But if the borrower owes $1,500 in payments and has a gross monthly income of $2,000, his DTI ratio would be 75%. Anthony, TX Big Spring, TX Brownfield, TX Cuero, TX El Paso, TX Fabens, TX Harlingen, TX Hereford, TX Lamesa, TX Levelland, TX Lubbock, TX Midland, TX Plainview, TX Seminole, TX Snyder, TX Stephenville, TX Sweetwater, TX. From $5,000 to $50,000. In this example, Excel would display $148. Some might even say that Viva Payday Loans is the best provider of car loan affiliate programs in the USA because of this. Collateral requirements: Some lenders only offer secured loans for borrowers who have low credit, which poses a risk to the borrower should they become unable to make the monthly payments.

Our Values

Social security is supposed to help provide in retirement; it’s not supposed to be a calculation of how fast can one get back the money she paid in. Cashfloat have some great advice on how to improve your credit score today. When taking out a payday loan, it is important to be aware of your rights, including the following. Seek assistance from local nonprofits, charities and religious organizations. 49 percent and go as high as 35. We want to make applying for a Boodle loan as fuss free and fast as we possibly can. Easy Online Unsecured Loans No Phone Calls Installment Payday Loans No Bank Account. Ask the lender if this is an option. You have completed the first step toward being debt free. The best online payday loan lenders should also offer customers the ability to apply online, with no need to fax documents or visit a physical location. While they are certainly much better than they were pre 2014, they won’t do your credit profile any good because they make you look like a risk to lenders. Com, LLC is a direct loan lender, however where we do not offer you an account with us, we may provide links or forms on websites, or in emails, SMS messages, and other lawful communication methods, to products from one or more advertisers and/or affiliates. Paycheck Progress Online. Borrowing a $5,000 loan is more than spare change.

General Loan

You will usually need to have a stable income and can afford to make monthly repayments. More employers than ever are conducting background checks that can include an investigation of your credit status. The right answer in your situation depends on your unique circumstances and can change over time. Once you have compared and found a lender that works for you, you can apply for a loan with them. 2 years to less than 3 year. This repayment example at the stated APR assumes 30 days to first payment, and that all payments were made on time, with no prepayments. What makes revenue based loans so helpful is that they are based on the revenues that your business generates and that this type of business loan is really quick and efficient. They also offer competitive rates and flexible repayment plans, making it easy to find the right loan for your budget. By definition, bad credit is an indication to loan providers that one borrower is riskier than another. It is easy to get online loan, for example in Bank of America. Based on evaluation of cash flow. We’re here to help when you do. That is how a $375 loan becomes nearly $500 in one month. We’re licensed by the Idaho Department of Finance. You can find out if you can borrow more online. Simple interest is interest on the principal loan. With the ease of availing loans, getting good returns on the money invested, no tangible paperwork, no wastage of time, extreme convenience and other such elements, P2P lending is soon expected to become the powerhouse of the fintech industry in the coming years. In the case of loans, affiliates will find plenty of traditional finance brands offering many types of products. Some lenders don’t disclose minimum credit requirements before applicants go through a prequalification process or apply for a loan.

Wealth Management

With financial technology, small business owners can access their financial information and make decisions from their desktop, laptop, or mobile device. 1 877 526 6332 Monday Friday 8:00 am – 7:00 pm Central Time. Whether you’re applying for or already have applied for one of our short term same day loans, you know that you can always get in touch and we will be happy to answer any questions that you have. If you’re permitted to accept the loan it is essential that you go through the terms and conditions of the loan to know your rights and obligations. A debt consolidation loan is a type of loan that helps you merge some or all of your existing debts into one. CCS is well recognised by the government, the banks and the courts. There are costs associated with filing, so you’ll need to figure out whether filing is the best choice for your situation. » COMPARE: See your bad credit loan options.

Refinance Loan

Online payday loans same day are an excellent option for those who need a short term loan to cover an unexpected expense or to make a purchase. If you need less than $100 a reserve line or credit card may be right for you. If you are self employed, we may be able to help if we can determine your regular income during assessment. Easy access checking with no account opening or monthly fees. Exposing your personal data unnecessarily can lead to an increased vulnerability to fraud or unnecessary emails clogging up your inbox with offers you do not want. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self selected credit score range can also impact how and where products appear on this site. Happy Teacher`s day to all the lovely teachers ❤️. When you start to delve deeper, the plethora of direct lenders available online can make you feel confused. Try to complete your application as accurately as possible. The following statistics are from the CFPB Consumer Complaint Database as of February 2021. Our office hours are:. However, it will not affect your chances to get a car title loan, as title loans are based on the equity in your paid off vehicle. This means that while using a broker can have an advantage of seeing what a range of unsecured lenders can offer you, it may not always be possible to get the best deal unless you come to the lender directly. After your loan is approved, the mortgage team will have three days to finalize all of your closing documents. Credit Building tools are designed to place new tradelines, or records of credit activity, on your credit report. QuidMarket is a direct lender of short term loans, which are an alternative to payday loans. A: No credit check loans typically work by the lender approving the loan without running a credit check. Prevent overdrafts on your U. Some applications may require additional verification to qualify, which could delay funding. However, whether this is a truth or a myth depends on various factors. You can also pay your bill early or make multiple payments each month, depending on the card. The second way is to go through an online lender that specializes in bad credit loans. The right of rescission period the starts the first business day after you have received and signed your mortgage note or promissory note and received the Closing Disclosure and two copies of the notice of the right to rescind.

Tags: